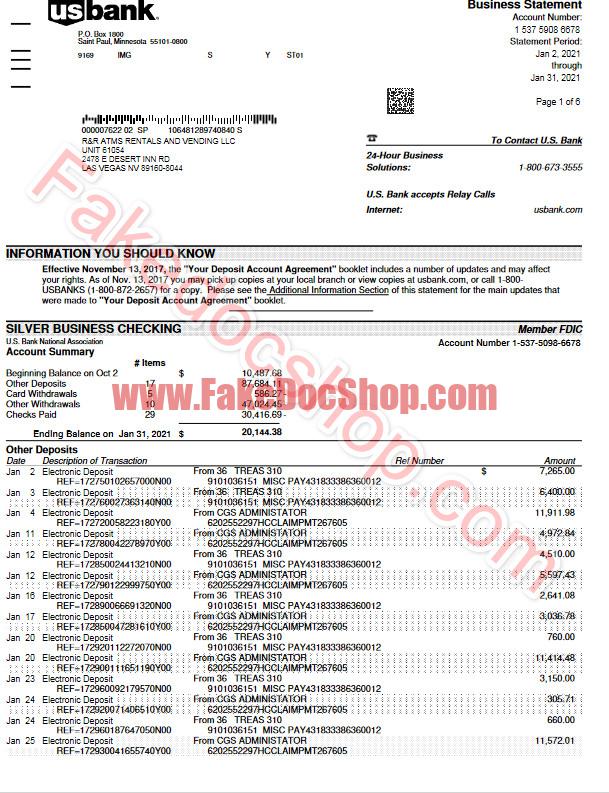

U.S. bank business Bank statement Template (10 Page)

U.S. bank business Bank statement Template (10 Page)

A U.S. bank business Bank statement, also known as a business bank statement, is a financial document provided by a bank to a business account holder. This statement provides a detailed record of all financial transactions related to the business’s bank account over a specific period, typically a month. Here are some key components typically found in a U.S. bank business statement: Account Information: This section includes the business’s name, account number, and the statement’s date range. Beginning and Ending Balances: The statement will display the balance at the beginning of the statement period and the balance at the end of the period. Transaction History: The bulk of the statement consists of a list of transactions. These transactions can include deposits, withdrawals, checks, electronic transfers, debit card transactions, and other activity related to the account. Each transaction typically includes a date, description, and the amount of money involved. Interest Earned/Paid: If the business account earns interest or incurs interest charges, this information will be detailed in the statement. Service Fees: Any fees associated with the account, such as monthly maintenance fees or transaction fees, will be listed on the statement. Check Images: Some bank statements may include images of canceled checks that have cleared the account. Additional Information: Depending on the bank and the specific account, the statement may contain additional information or messages from the bank. U.S. bank business statements are crucial for business owners and accountants to monitor the financial health of the business, track income and expenses, reconcile accounts, and prepare financial reports and tax returns. These statements provide a transparent record of the business’s financial activity and help with financial planning and decision-making. Businesses typically receive bank statements on a regular basis, such as monthly or quarterly, either in paper form by mail or electronically through online banking services. It’s important for business owners to review these statements regularly to detect any errors, unauthorized transactions, or discrepancies and to ensure the accuracy of their financial records.

- Fully editable Adobe acrobat template

- High quality template. Easy to customize, Layer based.

- You can edit this template and put any Name, Address, ID number, DOB, Height, Weight, Expiration Date, Photo & etc…

- To modify this template file you will need a photo editing software such as Adobe Photoshop!

- No Outdated Files!

To modify this pdf template file you will need This Softwares

You must log in to submit a review.