ING Bank Statement

ING Bank is a well-known Australian bank with over 2.8 million customers. It was founded in 1999 and was Australia’s first direct bank. Except for the customer service lounge at the headquarter office in Sidney, ING bank has no branch offices or ATMs of their own. Customers can complete their banking transactions online and access their money through any Australian ATM.

ING Bank offers a diverse portfolio of services beyond just your standard savings and checking accounts. Customers looking for lines of credit, personal loans, home mortgages, managed investments, or business banking accounts can find services to fit their needs. Many ING services offer rebates, discounts, and other incentives that help customers make the most out of their money.

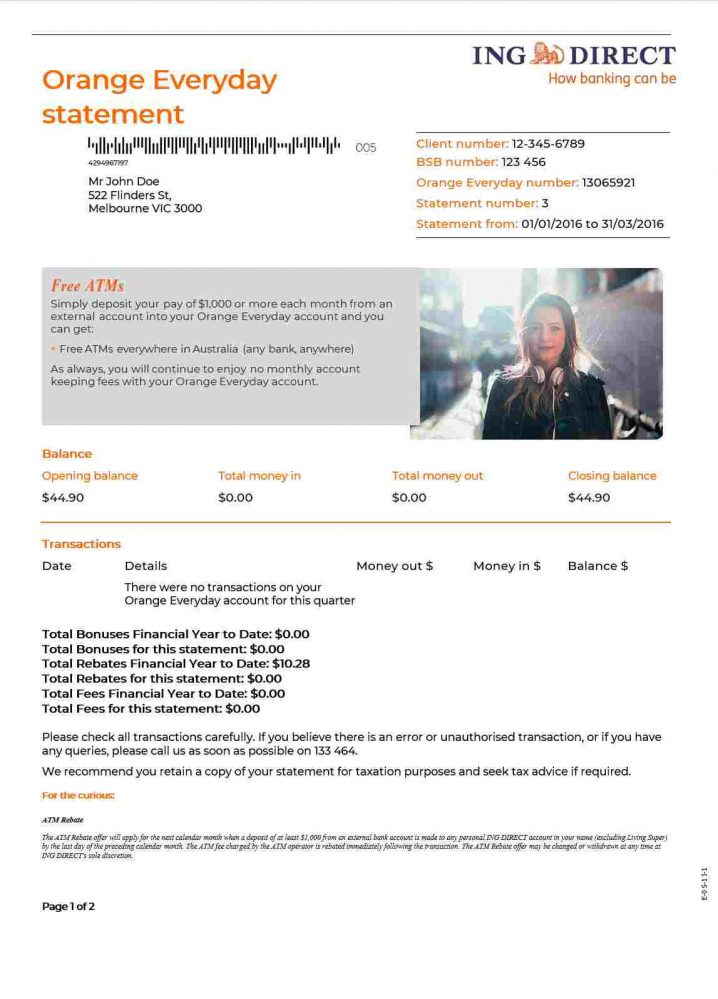

ING Bank Statement Template

ING regularly issues statements to their account holders. The statements are issued either monthly, every three months, every six months, or annually. The type of account you have will determine how frequently you receive a statement. You can use either your computer or the mobile app to view your IGN Bank statements after the bank has sent them to you.

To view your statements online with your computer, log into your account and click “Statements.” Then select “View statements” and the account you want to view. Finally, select the time frame you wish to see and click “Find.” For mobile viewing, log into your account on the app. Touch the down arrow beside your account name. There you can select “Statements” in the menu. You can then choose the dates and statements you want to view. Registered ING Bank customers can print and view online statements from the past seven years. Customers with closed accounts can also view their ING bank statement information online. For closed accounts more than seven years old, customers can contact ING staff members to order statements.

You must log in to submit a review.