Ally Bank Statement

Ally Bank is a digital financial services company with over nine million banking clients, including 2.39 million deposit customers. It is in the top 20 U.S. financial institutions and employs over 10,000 people. With a fierce commitment to “always do it right,” Ally financial boasts over 85.8% customer satisfaction.

Ally Bank offers a broad range of services, including checking and savings accounts, CDs, IRAs, and personal lending options. Money Magazine recently named their online savings account the ”High Yield Savings Account with the Best Online Tools.” They also offer brokerage services, home lending, corporate financing, and auto dealer financial services.

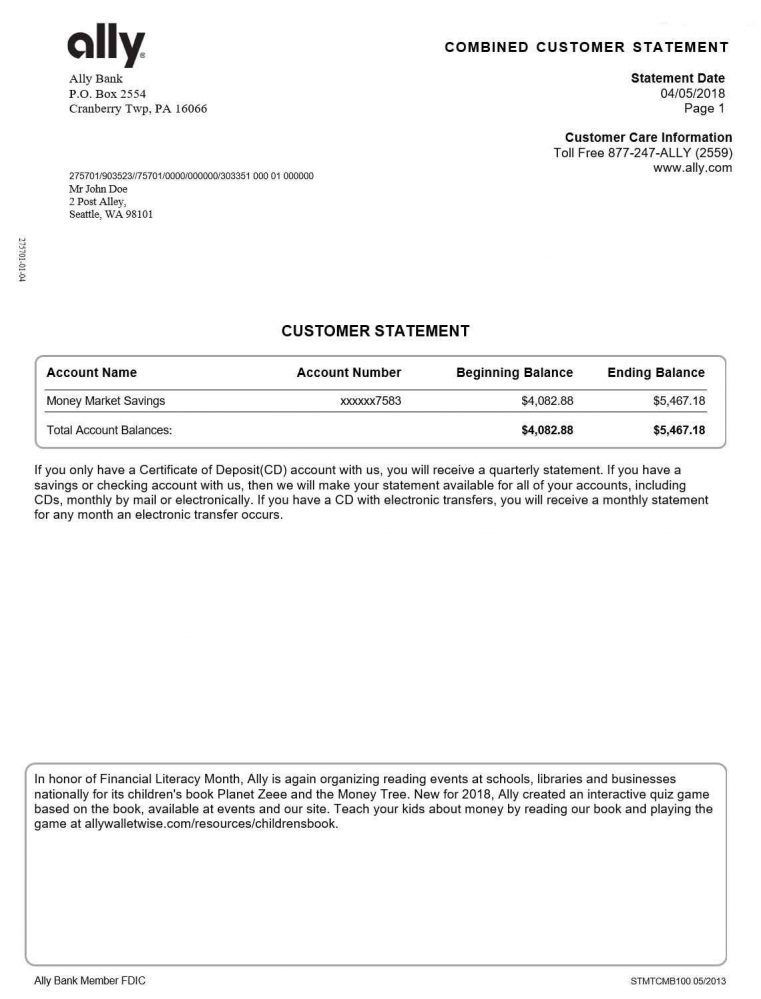

Ally Bank Statement Template

Getting your Ally bank statement is relatively simple. First, you’ll need to log into your account from the bank’s home page. Then select “Profiles and Settings” from the menu. From there, you’ll select “Statements and Tax Forms.” Next, choose “Statements” and then use the drop-down menu to access statements for the last seven years.

When you select a statement, it will automatically download as a PDF. The statement will clearly show the account name, account number, the beginning balance, and the ending balance for each account you have with Ally Bank. It will also show a phone number for their customer care team should you have any questions or concerns.

If you need to print the statement, you can open it from your computer’s download folder, then select the print option from the PDF’s toolbar. To access the bank statements, you need to be a primary account holder. As the primary account holder, you’ll be able to view statements for custodial, guardianship, and representative payment accounts as well. However, trust statements are not available online. Ally Bank will mail trust statements monthly for non-CD accounts and quarterly for CD accounts

You must log in to submit a review.